Bonus tax rate calculator

The calculator assumes the bonus is a one-off amount within the tax year you select. The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

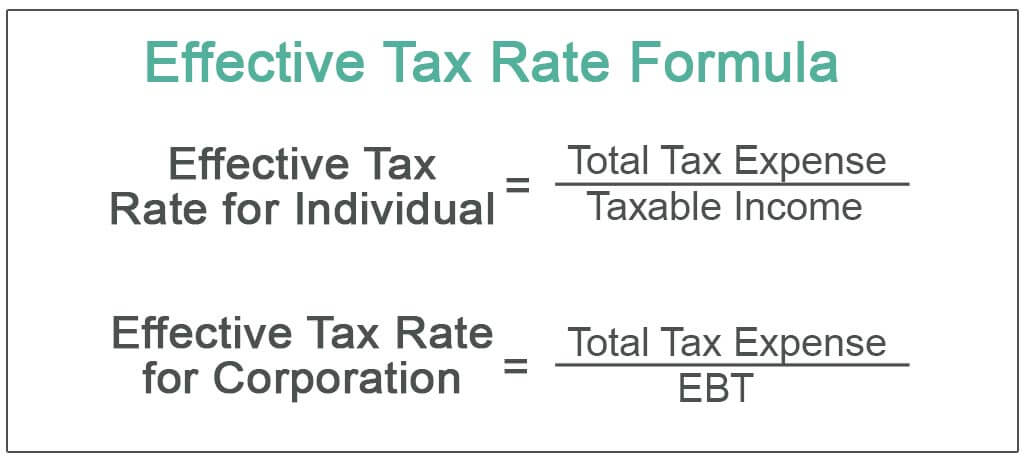

Effective Tax Rate Definition Formula How To Calculate

This calculator uses the.

. And you decide to pay her a 1500000 bonus. Avantis easy-to-use bonus calculator will determine the right pre-tax amount. The New York bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses. To calculate tax on a bonus you first need to determine which income tax brackets the employee falls under. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Bonuses over 1 million are taxed differently Your bonus amount below 1 million must have 22 withheld. On the other hand if you fall into a lower federal tax bracket your bonus may be taxed at a higher rate than your regular income. The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The next half million will. Anything above 1 million however is subject to withholding at 37.

This means that more of your bonus will be withheld but you. YEAR GROSS SALARY NET BONUS Province Net Bonus Federal Tax deductions Provincial Tax deductions. If you use flat withholding for bonuses you will simply apply a tax rate of 22 and pay the bonus by separate check.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. This includes all back payments commissions bonuses or similar payments. According to Revenue Canada these are Canadas federal income tax rates for.

The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Bonus for increase in the rating of the employee Bonus paid for incentive schemes offered by the employer If you earn a bonus for any of these reasons the bonus would be. If your state does not have a special supplemental rate you.

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. If you have other deductions such as student loans you can set those by using the more. The first million will be subject to that same 22 tax making the withholding 220000 taking it to 780000 after taxes.

This method calculates withholding by apportioning additional payments made in the current pay period. After subtracting these amounts if the total remuneration for the year including the bonus or increase is 5000 or less deduct 15 tax 10 in Quebec from the bonus or retroactive pay. If your employee makes more than 1 million in bonuses annually different.

2021 2022 Income Tax Calculator Canada Wowa Ca

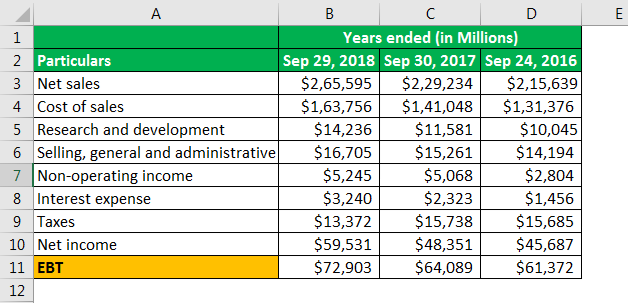

Effective Tax Rate Formula Calculator Excel Template

How Real Estate Investors Boost First Year Depreciation U S In 2022 Real Estate Investor Tax Reduction Tax Preparation

What Is Annual Income How To Calculate Your Salary

Avanti Bonus Calculator

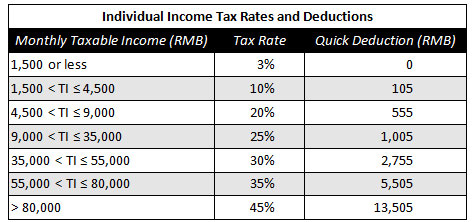

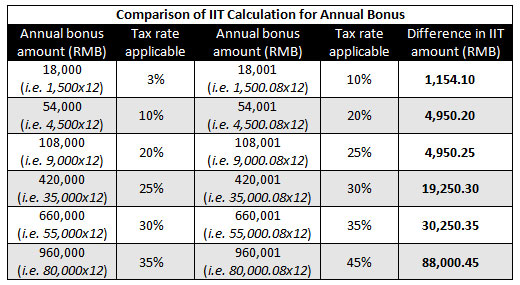

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Effective Tax Rate Definition Formula How To Calculate

Ontario Income Tax Calculator Wowa Ca

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

How To Calculate The Value Of Your Salary Benefits Job Interview Answers Salary Job Benefits

How To Calculate Income Tax In Excel

Bonus Tax Calculator Hotsell 58 Off Www Ingeniovirtual Com

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Time Management Worksheet

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

You Ve Saved Up A Down Payment You Re Pre Approved For A Mortgage You Ve Found A Place You Love Now H Buying First Home Home Buying Buying Your First Home

Budget Your Beautiful Bonus Metis Money Matters Budgeting Money Habits Money Matters

How To Calculate Income Tax In Excel